Calculate hourly rate for semi monthly payroll

The PaycheckCity salary calculator will do the calculating for you. Ensure you request for assistant if you cant find the section.

What Is A Pay Period How Are Pay Periods Determined Ontheclock

Major Occupational Groups Note--clicking a link will scroll the page to the occupational group.

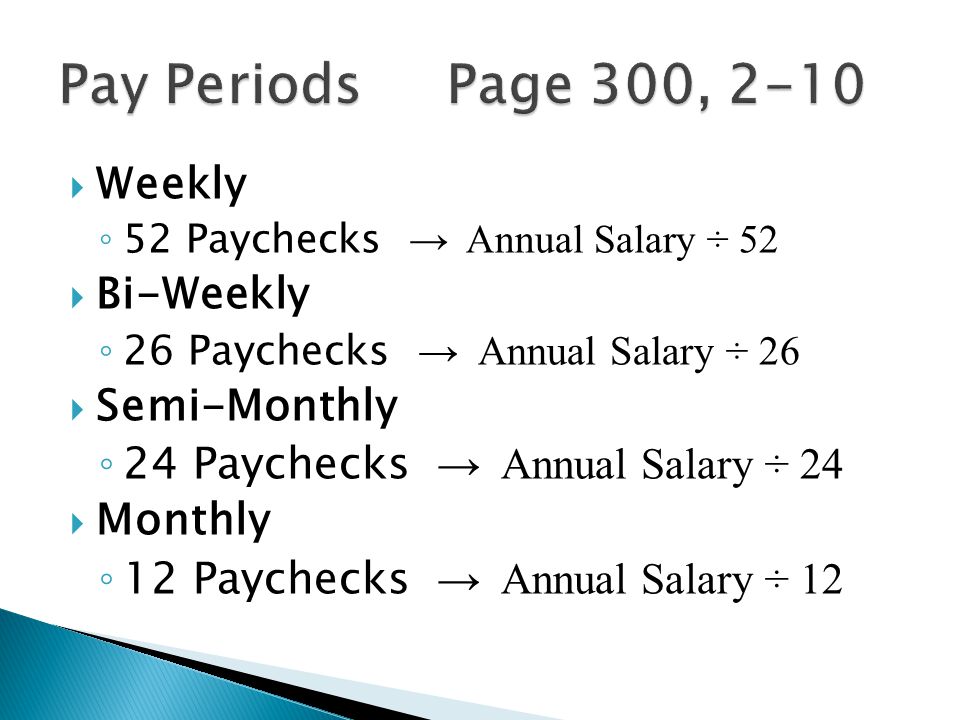

. A semi-monthly payroll occurs twice each month and 24 times each year. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. For hourly employees gross pay is the number of hours worked during the pay period multiplied by the hourly rate.

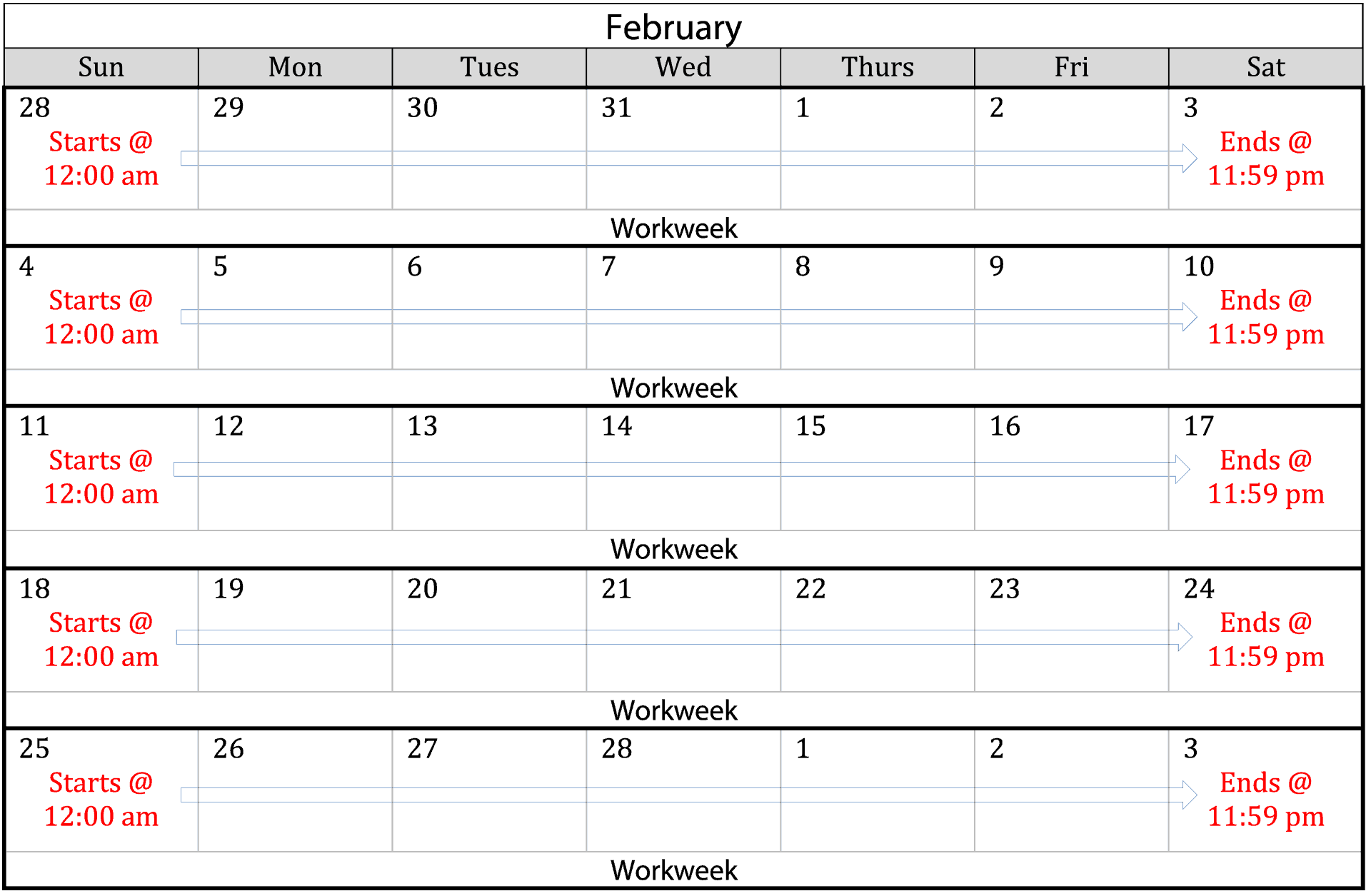

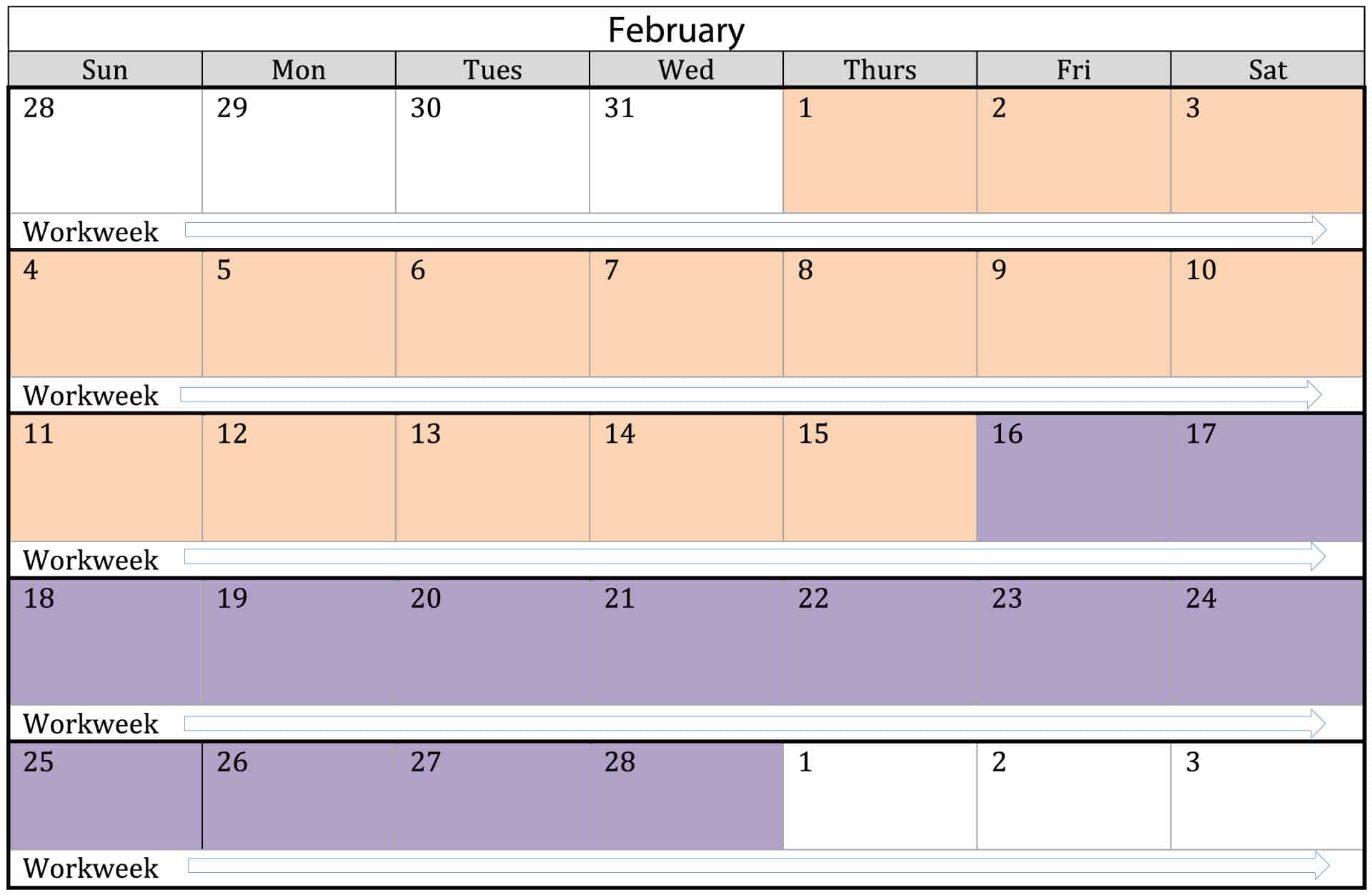

In the case of payroll periods semi-monthly usually means twice a month with one pay period starting the 1st day of the month and ending on the 15th day of the month and the other pay period starting on the 16th of the month and ending on the last day of the month. If employees are paid semi-monthly there are 24 pay periods. If you are not sure about your payroll schedule ask your supervisor or the payroll department of your company.

An hourly semi-monthly employees pay may fluctuate each pay period but a salaried employees tends to stay the same. Dont want to calculate this by hand. Also as you should know there are 2080 workdays in a calendar year 52 weeks multiplied by 40 hours.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Break down your wage into hourly monthly or annual income and more. Utah has a flat personal income tax rate of 495.

Firstly you need to know the annual salary of the employee. Consultants can also use this salary calculator to convert hourly rate to salary or annual income. Switch to Florida hourly calculator.

After filling out the order form you fill in the sign up details. Using a biweekly accrual rate makes the most sense when your employees are salaried and get paid the same each pay period. Switch to Oregon salary calculator.

Switch to Missouri hourly calculator. The hourly accrual rate is the best to use for accuracy but some businesses prefer to use a simpler calculation based on the fact that biweekly pay results in 26 payroll cycles per year. Determine how often youll pay your employeesweekly bi-weekly semi-monthly monthly or a different cadence all together.

The calculator works immediately as you slide or input your gross monthly income monthly debts loan. If youre a small business owner trying to figure out how to calculate payroll youre not alone. Access to our award-winning US-based customer service team.

Convert a salary stated in one periodic term hourly weekly etc into its equivalent stated in all other common periodic terms. Switch to Massachusetts salary calculator. After filling out the order form you fill in the sign up details.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. To calculate an hourly employees gross wages for a pay period multiply their hourly pay rate by their number of hours worked. 13-0000 Business and Financial Operations.

Monthly paychecks are paid at the end of the month. And if employees are paid once a month there are. Employees receive 24 paychecks per year.

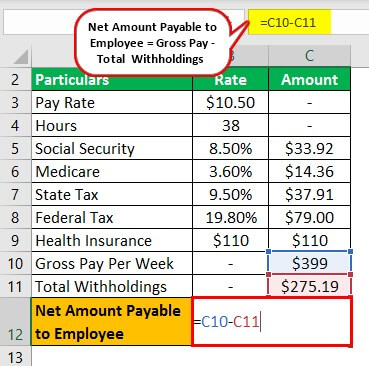

You calculate gross wages differently for salaried and hourly employees. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The Florida Reemployment Tax minimum rate for 20221 is 0129 and can be. How to Calculate the Prorated Pay. Utah is one of eight states in the United States that have a flat rate personal income tax.

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator. Employees receive 12 paychecks per year. Calculating the Semi monthly pay of a salaried employee.

Calculate required income for a specific loan amount for a Mortgage Refinance or Home Purchase. The semi-monthly salary of a salaried employee can be calculated in a very simple manner. Now we already know that a semi-monthly payment regime has 24 pay periods.

Federal Payroll Tax Payment Frequency. It typically takes 2 minutes or less to run payroll. Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Florida paycheck calculator.

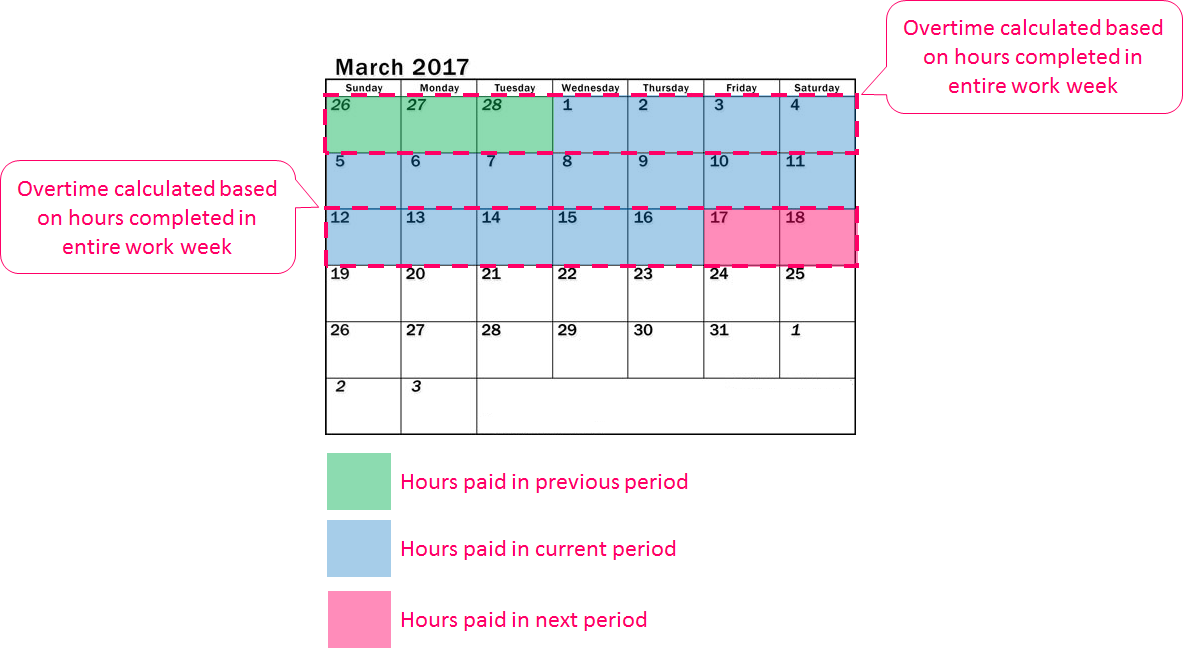

How to Calculate Overtime on a Semi-Monthly Pay Period. Are in the same boat as you. Large organizations might also have internal deadlines for time sheet submission between the end of the pay period and the pay day.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. Multiply their hourly rate by the number of hours they worked during the pay period. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level.

Remember if they took any. To prorate a semi-monthly salary you need first to find out the employees rate per day. There are 26 pay periods.

For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you would calculate as follows. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages is available in the downloadable XLS file. Switch to Arkansas salary calculator.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. 70 hours x 10 700 your gross semi. Semi-monthly paychecks are paid on the 1st and 15th of the month or the 15th and 30th.

Wages deductions and payroll taxes completed automatically. Its a challenge to manage employees calculate their hourly paychecks and process your payroll all while running a small business. This Oregon hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. A semi-monthly pay schedule for hourly employees might be on the 7th and the 22nd of the month for hours worked from the 16th to the end of the month and the 1st to the 15th respectively. Multiply hours worked by your hourly rate.

This number is the gross pay per pay period. Ensure you request for assistant if you cant find the section. This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Switch to Illinois salary calculator. Over six million small businesses in the US. How to Use This Salary Calculator.

Such as to calculate exact taxes payroll or other financial. For example if your receptionist worked 40 hours. Then figure out your employees gross pay for the pay period.

Let us assume that an employee earns a gross of 100000 annually. Subtract any deductions and payroll taxes from the gross pay to get net pay. Why Gusto Payroll and more.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This Arkansas hourly paycheck calculator is perfect for those who are paid on an hourly basis.

How To Calculate Pay Using The State Formula Rate Mit Human Resources

Paycheck Calculator Take Home Pay Calculator

The Pros And Cons Biweekly Vs Semimonthly Payroll

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Elaws Flsa Overtime Calculator Advisor

Salaries Ppt Video Online Download

What Payroll Schedule Makes Sense For Your Business Guide When I Work

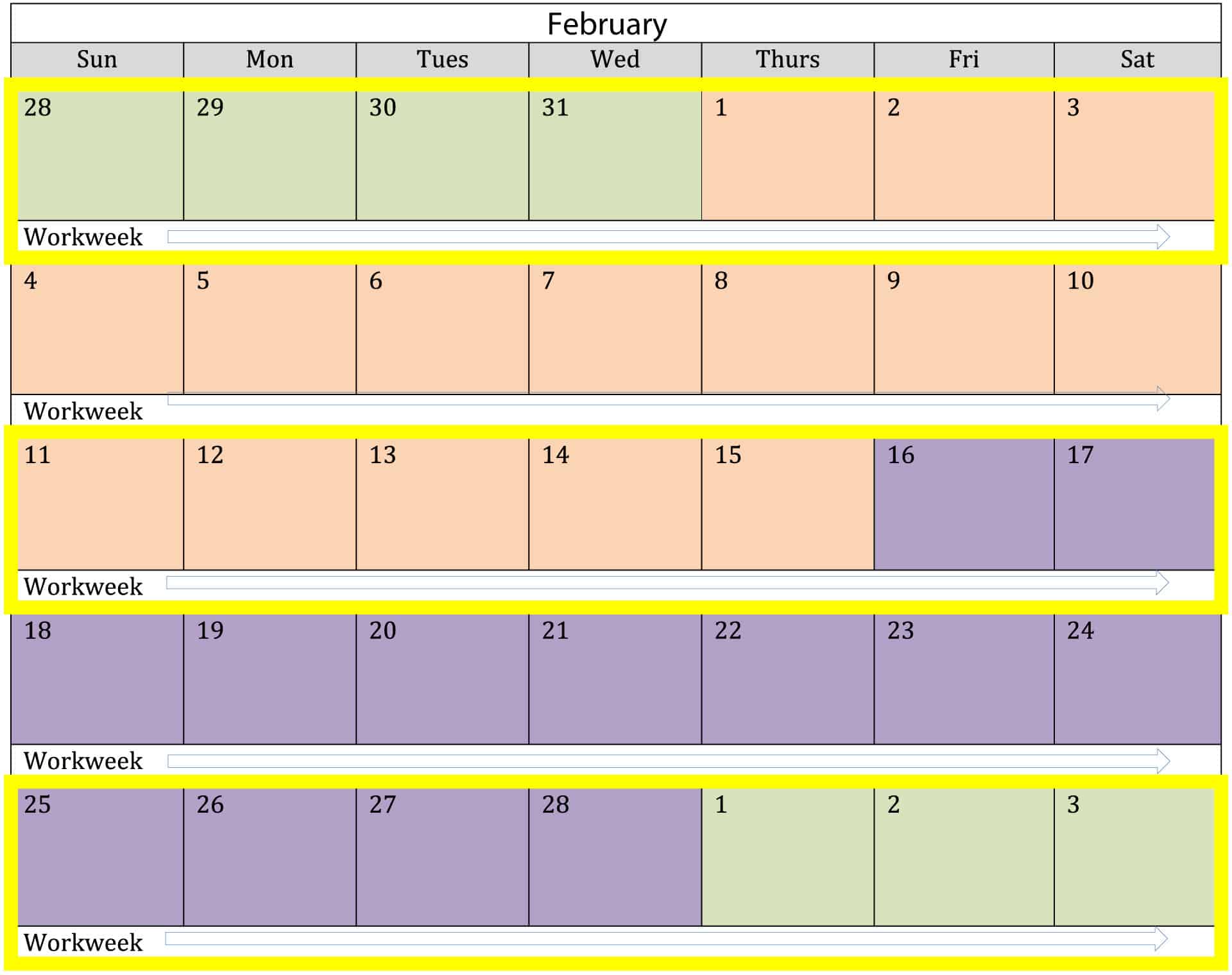

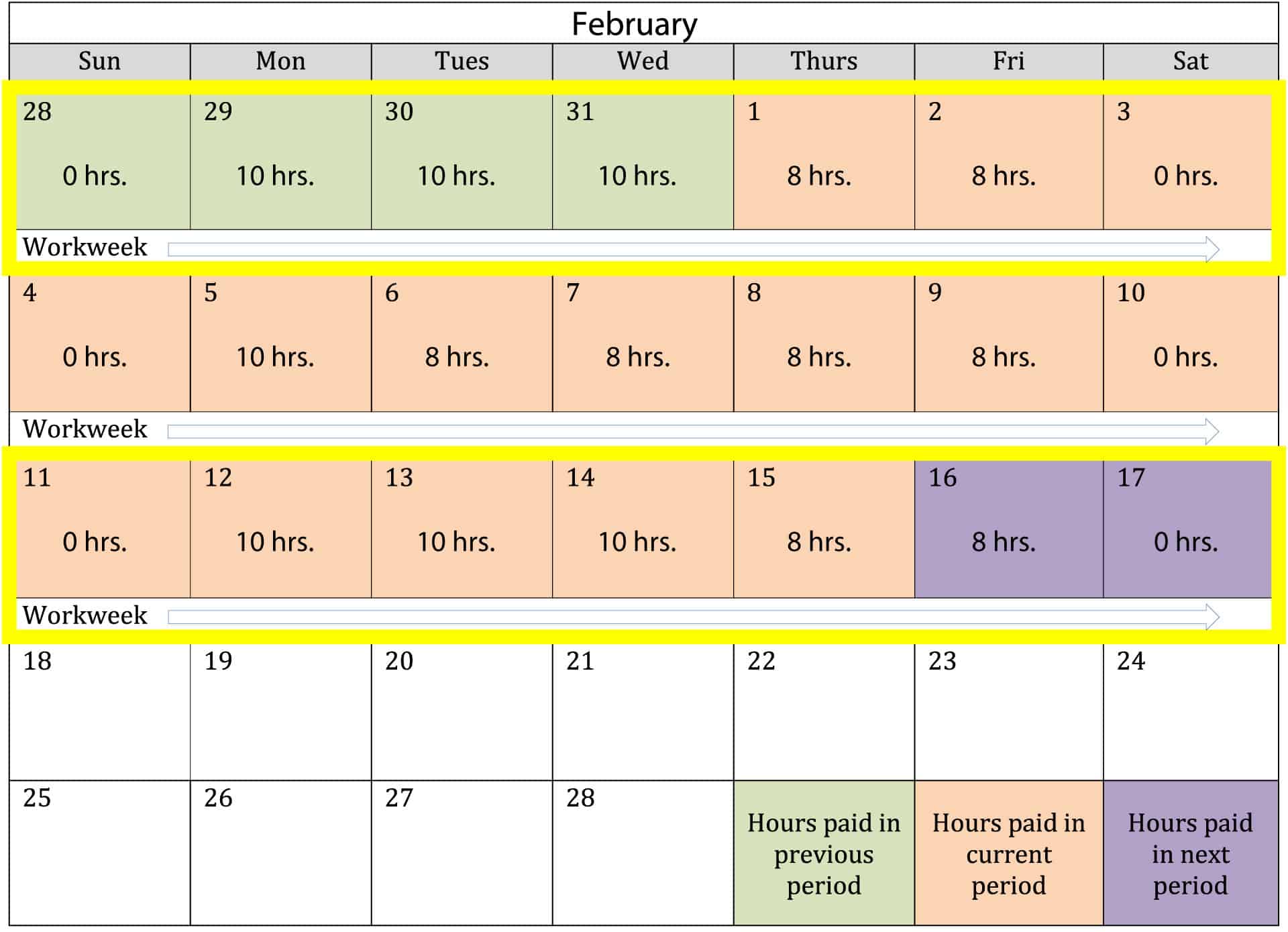

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

What Is A Pay Period Free 2022 Pay Period Calendars

![]()

Download Free Bi Weekly Timesheet Template Replicon

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Difference Between Bi Weekly And Semi Monthly Difference Between

Payroll Formula Step By Step Calculation With Examples

Semi Monthly Pay Period Timesheet Mobile

4 Ways To Calculate Annual Salary Wikihow